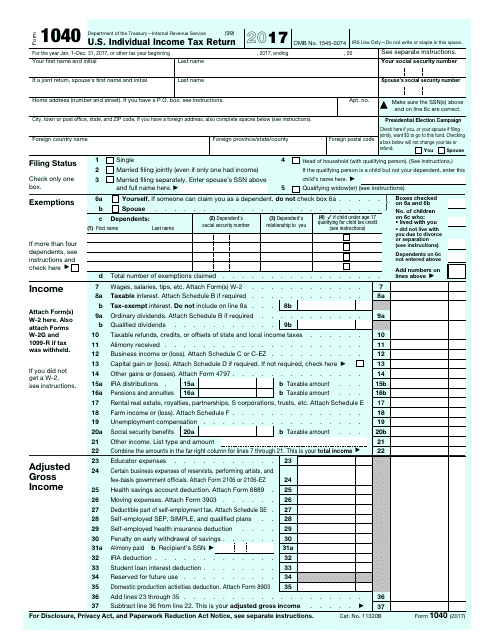

They receive this title because you have to remove them from your total income before you can get your AGI. These adjustments are called above-the-line deductions. Once you’ve written down all of your income, it’s time to make any necessary adjustments to that income. Using all these sources of income, you will calculate and enter your adjusted gross income (AGI) on Line 8b.

Then, you can enter information on any interest, dividends, pensions, annuities, individual retirement account (IRA) distributions or Social Security benefits. You also need to attach any and all W-2 forms you have. If you have a W-2, you will need to enter the earnings information from that form here. Lines 1 through 7 are all about your income. Next up, things get a bit math-intensive. If you work with a tax preparer or accountant to file your 1040, they’ll also sign and enter their information. You should do this after you have completed the rest of the form. The final part of the first page requires you to sign and then write in your occupation. You will also see a box that you should check to certify that you, your spouse (if you file jointly) and all of your dependents had qualifying health care coverage or a coverage exemption for all of the year. There is a box beside each dependent that you can check if you’re claiming the child tax credit or credit for other dependents. If you’re filing jointly, you also need to add the name and SSN of your spouse.įilers with dependents need to add the names, SSNs and the relationship (to the filer) of each dependent. This includes your name, address, Social Security number (SSN) and filing status. The first page asks for your basic personal details. The only exception to this is Form 1040NR, which nonresident aliens use. However, these forms are no longer in use because of the tax plan that President Trump signed into law in late 2017. Previously, filers with simple tax situations could use the 1040EZ or 1040A. Individual Income Tax Return.” As of 2019, there is only one version of the Form 1040, which means all tax filers must use it.

The full name the IRS gives to Form 1040 is “Form 1040: U.S.

0 kommentar(er)

0 kommentar(er)